GSTN Advisory: Introduction of 'Import of Goods' section in IMS

Dated: 30.10.2025

The Invoice Management System (IMS) was introduced on the GST portal from the October 2024 tax period. It enables recipient taxpayers to accept, reject, or keep pending individual records uploaded by suppliers through GSTR-1/1A/IFF. This functionality empowers recipient taxpayers to manage their inward supplies by taking actions on individual records on GST portal itself.

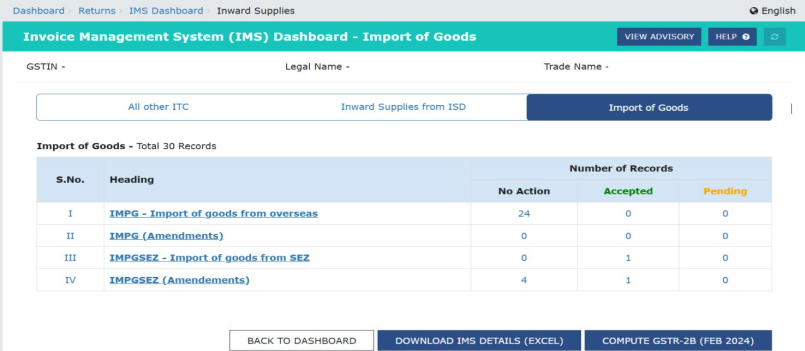

To further enhance taxpayer convenience, a new section "Import of Goods" has been introduced in IMS wherein the Bill of Entry (BoE) filed for import of goods including import from SEZ, will be made available in IMS for taking allowed action on individual BoE. This functionality will be available from Oct-2025 period onwards.

Recipient taxpayers will have the option to either accept or keep a BoE pending. It may be noted that If no action is taken on an individual BoE, it will be treated as deemed accepted. Based on the action taken, the GST Portal will generate the draft GSTR 2B for the recipient on 14th of subsequent month. However, the action taken can be changed even after generation of draft GSTR-2B till filing of the corresponding GSTR-3B.

The below mentioned sub-sections will be available under "Imports of Goods" section. Taxpayers can view & take action on bills of entry accordingly:

1. IMPG - Import of Goods from overseas: For all original BoEs filed for import of goods from outside India.

2. IMPG (Amendments): For amendments made to BoEs filed for import of goods from outside India. This includes Value amendments as well as GSTIN amendments (newly introduced for change of GSTIN in BoE).

3. IMPGSEZ - Import of Goods from SEZ: For all original BoEs filed for import of goods from SEZ.

4. IMPGSEZA (Amendments): For amendments made to BoEs filed for import of goods from SEZ. This includes Value amendments as well as GSTIN amendments (newly introduced for change of GSTIN in BoE).

Handling of GSTIN change in BoE through IMS:

At present, value amendments made to Bills of Entry are being processed in the GST system. This process will continue to be handled through the Invoice Management System (IMS) as well.

GST is a self-assessment based tax regime. Taxpayer need to ascertain the ITC eligibility as per the provisions of the law and rules made thereunder. In cases where the GSTIN in a Bill of Entry has been amended and the previous GSTIN (G1) had already availed Input Tax Credit (ITC) on that Bill of Entry, the previous GSTIN is required to reverse ITC amount availed on such BoE. Hence, entry for reversal of ITC due to amendment in GSTIN in BoE will be shown to the previous GSTIN (G1). However, to address the scenarios where the ITC has already been reversed either partially or fully by the previous GSTIN, an option has been provided to the previous GSTIN to declare amount of ITC needs to be reversed based on amount of ITC availed earlier (not exceeding the original value as per the Bill of Entry).

Key Points on ITC reversal from Previous GSTIN:

1. Records with GSTIN amendments shall be shown with "Amendment Type" as "GSTIN" under IMPGA/IMPGSEZA categories.

2. ITC reversal entry to Previous GSTIN (G1) will be displayed in blue under IMPGA/IMPGSEZA categories.

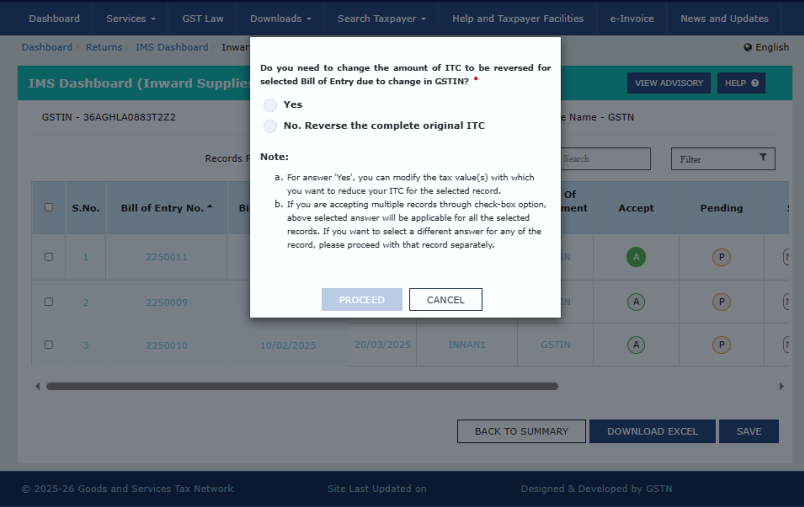

3. The Previous GSTIN will be given option to choose "Do you need to change the amount of ITC to be reversed for selected Bill of Entry due to change in GSTIN?"

a. Select "Yes" if Taxpayer need to provide input as mentioned below in "Amount declared by taxpayer for ITC reduction" field:

i. Zero value, in case the ITC for Previous BoE was not availed earlier or has already been reversed completely.

ii. the amount of ITC to be reversed in case ITC for Previous BoE has been partially reversed earlier. Such declared value will be adjusted from the available ITC in GSTR-2B accordingly.

b. Select "No" in case full reversal is required. Which means the complete ITC was availed by previous GSTIN. The original value of BoE will be reversed from previous GSTIN and will be made available as ITC to amended GSTIN (G2).

4. In case no input given by the taxpayer, the ITC reversal will be deemed accepted and original ITC amount of BoE shall be adjusted from the available ITC in GSTR-2B of GSTIN (G1).

5. For the amended GSTIN (G2), such BoEs will be shown under IMPGA/IMPGSEZA categories and ITC will be made available in GSTR-2B accordingly.

Note: For all BoEs where GSTIN amendment has been taken place before 1st November 2025, such BoE will be made available in IMS. In this regard, please note the following:

a. The GSTIN amended records will be displayed under IMPGA in the IMS dashboard of both the amended GSTIN (G2) & previous GSTIN (G1). Taxpayers may take allowed actions on such entries and ITC will flow to GSTR-2B accordingly. ITC reversal will be made from previous GSTIN(G1) and the applicable ITC will flow to amended GSTIN(G2).

b. For a BoE which has undergone GSTIN amendment and later in the same value amendment was also carried out. In such BoE GSTIN amendment was not processed in GSTR-2B (as GSTIN amendment wasn't transmitted from ICEGATE to GSTN), however value amendment with amended GSTIN was processed in GSTR-2B of GSTIN (G2) (as this was transmitted from ICEGATE to GSTN), In such cases a reversal entry will be shown to the previous GSTIN (G1) only in the IMS. However, no further record will be shown to the amended GSTIN (G2) since applicable ITC has already been given to such GSTIN (G2).

Ex: For BoE no. 10123, (with GSTIN say, "G1") a GSTIN amendment was done in June 2025 (changed to say, "G2"), and a further value amendment was done in July 2025. The Value amendment was already processed in GST system and ITC had flown to G2 in July 2025 for the amended value. Hence, upon processing of the GSTIN amended record now, a reversal entry shall be shown to G1 only, but no value amended record shall be shown to G2 (since G2 has already claimed ITC based on value amendment record).

Actions Allowed on Bills of Entry:

Following types of actions are allowed for Bills of Entry under Import of Goods section of IMS Dashboard:

1. Accept: To accept the records. Accepted records will become part of 'ITC Available' section of respective GSTR 2B (based on existing GSTR 2B rules). ITC of accepted records will be auto populated in GSTR 3B.

2. Pending: To keep the record on hold. Pending records will not become part of GSTR 2B and GSTR 3B. Such records will remain on IMS dashboard till the time same is accepted.

3. No Action Taken: If no action is taken by the recipient. These records will be treated as deemed accepted at the time of GSTR-2B generation.

Key Points regarding treatment of BoE in IMS:

1. "Reject" action is NOT allowed for Bills of Entry.

2. "Pending" action is NOT allowed in the following cases:

a. Downward value amendment of BoE where the action on the original BoE was accepted & corresponding 3B has been filed.

b. For reversal of ITC in case of GSTIN amendment of BoE for the previous GSTIN.

3. In case of multiple value amendments of a BoE, the latest record shall be shown in the IMS.

4. In case of the following scenarios, actions taken on the records shall not be saved and a partial save message shall be displayed:

a. Attempting to save pending action on downward amended BOE (where original BOE was accepted and respective ITC availed in GSTR-3B).

b. Attempting to save pending action on GSTIN amendment record requiring reduction of ITC.

c. Attempting to save the action on amended record where original record is kept pending. In such case the taxpayer first needs to take action on pending original record.

5. In certain scenarios the BoE will be removed automatically from the IMS dashboard. An information message will be displayed upon removal of records from IMS. Following are the circumstances where such removal occurs:

a. When GSTIN amendment of BoE happens before filing of GSTR-3B by previous GSTIN (G1) or the original BoE was kept pending, then the original BoE shall be removed from IMS dashboard of the previous GSTIN (G1).

b. When there are multiple value amendments for a BoE, then the latest amendment record replaces the earlier amendment record on IMS dashboard. Here, the earlier amendment record shall be removed from IMS.

6. In case the amended BoE is deemed accepted, the corresponding pending BoE will be removed from IMS dashboard on filing of GSTR-3B.

7. Optional functionality of providing Remarks will be applicable when taxpayer wishes to keep a record pending.

8. At the time of GSTR 2B generation, a record will be considered as 'Deemed Accepted' if no action is taken on that record in IMS.

9. It is mandatory to recompute GSTR 2B from IMS dashboard in case of any change in action already taken on concerned records or any action is taken after 14th of the month i.e. date of generation of Draft GSTR-2B.

10. All the accepted/ deemed accepted BoE records will move out of IMS dashboard after filing of respective GSTR-3B.

11. Pending records will remain on IMS dashboard and these records can be accepted in future months.

12. Certain changes are made to GSTR-2B:

a. Following additional columns shall be displayed under IMPGA & IMPGSEZA:

i. Type of Amendment

ii. Whether ITC needs to be reduced for the selected Bill of Entry' (Yes/No)

iii. Amount declared by taxpayer for ITC reduction - IGST

iv. Amount declared by taxpayer for ITC reduction - Cess

b. Removal of column for "Amended (Yes/No)".

c. The GSTR-2B excel shall now have 4 sheets for import of goods - IMPG, IMPGA, IMPGSEZ & IMPGSEZA.

13. Following changes are made to GSTR-2A pursuant to processing of BoE GSTIN amendments:

a. Introduction of new column for "Type of Amendment" in "Amendment History". Type of amendment shall indicate "Value" (in case the value of BoE amended) or "GSTIN" (in case the GSTIN of BoE changed) or "NA" (for original BoE).

b. The record for previous GSTIN will continue to be shown in their GSTR-2A of such month. Details of GSTIN amended record shall be available under Amendment History.

c. The record for the amended GSTIN will be shown in their GSTR-2A of the month when such GSTIN amended record is processed. Details of original record shall be available under Amendment History.

*******